By Gary Symons

TLL Editor in Chief

The global economy is in for a rough ride as US trade tariffs are expected to cause a widespread decline in GDP growth.

The OECD (the Organization for Economic Co-operation and Development, representing the world’s richest economies) headed their interim report in March with a photo of a ship being battered by heavy seas (above), a metaphor for what it says will be a difficult future due to “the fragmentation of the global economy.”

The OECD says the main reason is the impact of tariffs being imposed by the Trump administration in the United States, causing higher prices and casting a pall of uncertainty over global trade.

The organization says the countries most affected by the decline in economic fortunes will be Mexico, the US, and Canada, which are currently embroiled in a trade war. The United States is also the most active country in the global licensing industry, and a decline in both the US economy and the overall global market is expected to cause a decline in retail sales through 2025 and 2026.

As a result, the OECD has downgraded its projections for GDP growth globally, but particularly for the countries most affected by US trade tariffs, which ironically includes the United States itself.

The global economy was expected to grow by 3.3% in 2025 and in 2026. The global growth rate has now been downgraded to 3.1% in 2025 and 3.0% in 2026.

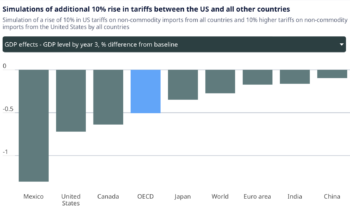

The decline becomes more apparent when you look at specific countries that are involved in the trade war. The OECD is basing these projections on a simulation that assumes bilateral tariffs are raised permanently by 10% on all non-commodity imports into the United States with corresponding increases on tariffs applied to non-commodity imports from the United States in all other countries.

The decline becomes more apparent when you look at specific countries that are involved in the trade war. The OECD is basing these projections on a simulation that assumes bilateral tariffs are raised permanently by 10% on all non-commodity imports into the United States with corresponding increases on tariffs applied to non-commodity imports from the United States in all other countries.

Higher tariffs would therefore cause a larger impact of growth, while lower tariffs would result in a more positive outcome.

However, under that scenario, Mexico is expected to be the most affected, as it is heavily dependent on the US market. Expected to grow by 1.5% in 2025, that rate has been downgraded to a shrinkage of -1.3% for 2025, and -0.6% in 2026, plunging that country into a two-year recession.

The United States is predicted to see the second largest impact. The projected 2.8% growth expected in 2025 has been downgraded to 2.2% for 2025, and an even more dismal 1.6% in 2026.

Canada’s projected growth rate has been downgraded by over 50%, dropping from an expected 1.5% growth without tariffs, to 0.7% in both 2025 and 2026.

In terms of overall decline, the OECD says Mexico fares worst with a 1.3% drop from the baseline, non-tariff projections; the US is next with a 0.72% drop; and Canada is third worst affected with a 0.64% decline from baseline.

The United States’ third largest trading partner, China, will also see an impact from tariffs. It’s economy is projected to slow from 4.8% this year to 4.4% in 2026.

The OECD as a whole is expected to see a decline of 0.5% from baseline.

Donald Trump’s trade wars are splintering the global economy and unpicking progress made to reboot growth and tackle inflation, the Organisation for Economic Co-operation and Development has said.

In its latest update on the health of the world economy, the leading Paris-based institution downgraded the prospects for global growth this year and next, including a sharp hit to activity in the US, Canada and Mexico.

Recent activity indicators point to a softening of global growth prospects,” the OECD summed up. “Business and consumer sentiment have weakened in some countries. Inflationary pressures continue to linger in many economies. At the same time, policy uncertainty has been high and significant risks remain.

LEGO and Pokémon Join Forces to Build an Exciting New Play Experience

“Further fragmentation of the global economy is a key concern,” the OECD added in its report, noting that any increase in tariffs, as has been proposed by the White House, would result in both higher inflation, increased unemployment, and lowered GDP growth.

“Higher-than-expected inflation would prompt more restrictive monetary policy and could give rise to disruptive repricing in financial markets,” the OECD explained. “On the upside, agreements that lower tariffs from current levels could result in stronger growth.”

It reduced its US growth forecasts from 2.5% to 2.2% for this year and from 2.1% to 1.6% in 2026. Growth in China is projected to slow from 4.8% this year to 4.4% in 2026.

In its first report since Trump’s return to the White House in January, the OECD said a further escalation of trade tensions would cause significantly more damage for the world economy.

Tariffs imposed thus far are lower than the White House has threatened to impose on its major trading partners, but the Trump administration has left the door open to much higher tariffs, particularly if or when affected countries impose retaliatory tariffs.

The National Retail Federation said higher tariffs would have a major impact on consumer spending.

The NRF’s study, “Estimated Impacts of Proposed Tariffs on Imports: Apparel, Toys, Furniture, Household Appliances, Footwear and Travel Goods,” examined how former President Donald Trump’s tariff proposals—a universal 10-20% tariff on imports from all foreign countries and an additional 60-100% tariff on imports specifically from China—would impact six consumer products categories: apparel, toys, furniture, household appliances, footwear and travel goods.

It showed that the proposed tariffs on those six product categories alone would reduce American consumers’ spending power by $46 billion to $78 billion every year the tariffs are in place.

“The proposed tariffs would have a significant and detrimental impact on the costs of a wide range of consumer products sold in the United States, particularly on products where China is the major supplier,” the NRF said. “The increased costs as a result of the proposed tariffs would be too large for U.S. retailers to absorb and would result in prices higher than many consumers would be willing or able to pay.”